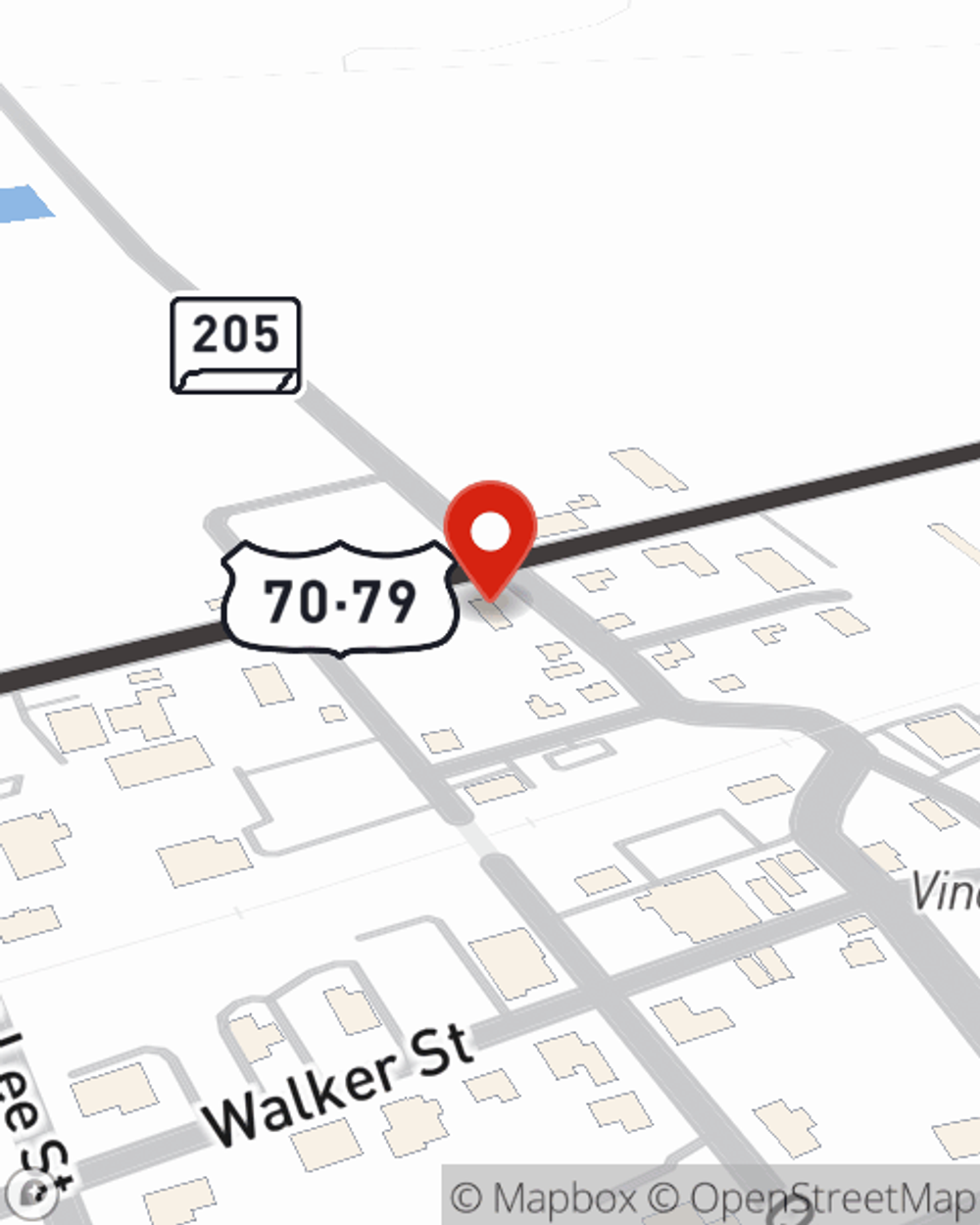

Business Insurance in and around Arlington

Get your Arlington business covered, right here!

Helping insure small businesses since 1935

Business Insurance At A Great Value!

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or accident. And you also want to care for any staff and customers who get hurt on your property.

Get your Arlington business covered, right here!

Helping insure small businesses since 1935

Strictly Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Ginna Walker is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Ginna Walker can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by visiting State Farm agent Ginna Walker today to investigate your business insurance options!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Ginna Walker

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.